Examination of web 3 gaming 'guilds': how they work and how they should work

Introduction

Play-to-earn games have led to the uprise of a phenomenon known as “guilds”.

These aren’t the traditional guilds that you see in MMORPGs where players team up in a clan to take on other players or monsters.

These are more like businesses that create a model of investment and participation between games, investors and players.

Guilds were popularised by Yield Guild Games, who were the first to identify that there was a gap in the market between players who wanted to play and earn, but couldn’t afford to buy NFTs, versus investors who had capital or NFTs but lacked the time to play games.

A model was born called ‘scholarships’, where a guild would lend NFTs to players in exchange for a share of the profits.

Fast forward less than a year, and there are now probably 10,000+ guilds in existence of various sizes.

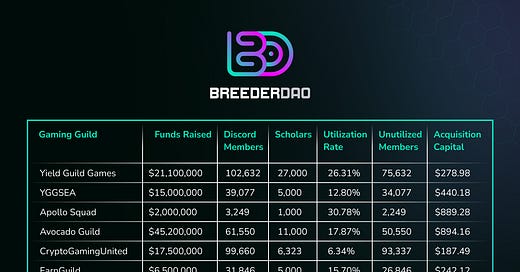

According to BreederDAO, the top 25 guilds have raised $500m+ and facilitate 100k+ scholars, with over 900k+ unutilised members on their ‘waitlist’. What this means is there is massive demand and opportunity for games to collaborate with guilds.

Guilds are fascinating from the perspective of both investors and players. They solve problems that exist for these two groups.

But what about from the perspective of the game developer itself? Let’s dive in…

Types of Guilds

There are different types of Guild models that exist. Each of them have different implications for game developers.

A. Yield Maximising Guilds

The focus of this type of guild is on its return on assets. These guilds invest in NFTs and aim to rent them out to players, with the goal of generating long-term yield.

Business model

A typical flow of funds in this involves:

Guild purchases assets

Guild lends assets to scholars who play the game and share in returns

Returns are re-invested into assets in existing and new games

Yield Maximising guilds tend to compete based on their ability to generate yield, which is usually via ability to make investments, quality of scholars, operational ability to scale or other methods. Some examples of ‘unique differentiators’ might be:

Using tools to automate asset lending, cashing out, or onboarding

Leveraging data-analytics or experts to build the best teams to maximise yield

Use ‘coaching’ or onboarding to create high performing scholars who compete at the top of leaderboards

Leverage scholar network and marketing power to get ‘bulk purchase’ deals with upcoming NFT games, thereby reducing cost of NFT acquisition

Challenge for game developers

The challenge of Yield Maximising guilds for a game developer is that they are, by design, intended to maximise the revenue that they extract from a game while minimising their contribution. Thereby maximising their ROI.

This directly conflicts with the goal of the game which is likely to have a sustainable game economy where participants are adding net value (whether financial or not), rather than extracting the maximum amount.

Given the purchasing power of guilds, it’s also possible for yield maximising guilds to ‘crash’ a game economy if they suddenly decide to exit their investment or take those cashflows to another game.

All-in-all, yield maximising guilds can threaten the economic sustainability of a game if mis-incentivised.

Note that these guilds aren’t all negative for games. They often can bring very high volumes of players and large amounts of investment & liquidity to a gaming ecosystem. The main question is whether that is sustainable.

B. Investment Fund Guilds

The second model that exists is the ‘Investment fund’ model, where Guilds primarily aim to invest in games and other projects to earn a return over time.

Business model

These guilds typically still have a traditional scholarship arm, but they approach scholars as an enabler to getting into highly coveted private sales, rather than as the core revenue driver. As such, it’s possible that scholarships may operate at a loss rather than to maximise ROI.

That last sentence is important, so I’ll repeat it. These types of guilds aren’t maximising for scholar ROI, and instead monetise via traditional investment returns and assets under management. Large number of scholars and brand value is an input (not an output) to get leverage to get good deal flow.

The flow of funds here would be two-fold:

Guild purchases assets

Guild lends assets to scholars who play the game and share in returns

Returns are re-invested into assets

Guilds also invest in upcoming games (both NFT private and token private sales) and generate a return

Challenge for game developers

Game developers should approach these guilds the same way they would in qualifying VCs in sales - based on the value-add, network and reputation of these guilds

As with VCs, game developers will also need to create long-term partnerships with these Guilds rather than incentivising them to ‘dump’ or take short-term profit

Game developers may run into the same problem as in model A, where the ‘scholarship’ division of this guild is still looking to maximise ROI or minimise loss. Although for these guilds, reputation matters so you are less likely to see them completely exit or abandon a partner.

C. Value-add Guilds

This next category is more vague, but broadly refers to guilds who actively aim to create win-win scenarios with games by being value added. Their business model likely still includes scholarships and potentially investment funds, but is predicated around adding value outside the game as well.

Business model

Guild purchases assets

Guilds create value for games in some way: for example via player participation, marketing, community, esports, content, tools or other mechanisms

Guilds and scholars earn based on their contribution (financial + non-financial)

Earnings are re-invested into assets and new ways to grow the game

Challenge for game developers

Identifying what type of ‘value added’ contribution makes sense to collaborate with guilds on and agreeing on these as per more traditional ‘partnerships’

Creating the right win-win incentives and operational frameworks

Measuring and quantifying non-financial benefits

D. Services for Guilds

As guilds continue to increase in popularity, we’re beginning to also see an infrastructure & tooling layer get created. These might be asset lending services, open-source scholar management scripts, asset crafting or breeding services for Guilds, pooled investment vehicles for small investors (or guilds) to operate as a bigger one, guild comparison services for earners, and more.

This last category is important to understand as they determine how easy or hard it is for someone to create a new guild for your game, and impact the guild ecosystem as much as the guilds themselves.

Challenges & opportunities for game developers

Currently a majority of guilds, in particular smaller guilds, are focused on yield maximisation. This could be seen as a ‘threat’ to games with any investment-based earning component.

However, it’s unfair for game developers to ‘blame’ any guilds for the way they operate. The nature of any open economy is that you will have different participants in the ecosystem, each with their own goals and business models.

Instead, game developers have the onus of understanding what guilds intend to do, and in designing the right mechanisms and processes that ensure guilds are net value-adders to the game ecosystem. This means intentionally creating incentives, partnerships and game systems that factor in the behaviour of both small and large guilds. Ultimately their business models are based on the incentives and systems that we create.

Instead of viewing guilds as a ‘threat’ or ‘value extracting’, game developers should look at this as an opportunity to embrace web 3 and new business models.

The best games and guilds will be able to tap into this opportunity.

Note: Personal thoughts only. Would love to get more insights on Guilds and potential new models that could work. If you’re a guild and want to partner with Guild of Guardians, my DMs are open: www.twitter.com/xdereklau.